Top Money-Saving Apps of 2018

We’re always on the lookout for the next thing to buy, whether this is an everyday essential such as toilet roll or an everyday luxury like an upmarket coffee-shop flat white. You work hard so that you can buy these things, so why not?

Making a purchase has never been easier, and this is largely down to technology. Contactless payments allow you to spend without a second thought, and you no longer have to go through the period of contemplation between choosing an item and entering your pin. This means that you spend more on a day-to-day basis, but if technology is the cause, it is also the solution.

Get Money-Smart By Using Tech

There are plenty of apps and websites out there to make sure you get the most out of your money, it’s just knowing where to find them and how to use them. Whether it’s finding the latest voucher codes or getting the best travel deals, tech is changing the way we manage our finances for the better.

1. Monzo

Price: Free

Since launching its current account, Monzo has become a digital bank that gives you full control over your finances. The best way to use Monzo is to treat it as your everyday bank. Your wages, student loans, and other sources of income will go into your high-street bank account, and you just use your Monzo card for day-to-day purchases. If you want to set yourself a budget of £50 per week, all you have to do is transfer that over to your Monzo account and use the Monzo card to pay for things (just as you normally would with your high-street bank card).

Here’s the clever part: the card comes with a smartphone app that tracks your spending, calculates what you spend most of your money on, and sends you a balance-update notification after each purchase. So, not only do you have full visibility when it comes to your finances, but you also have useful insights to help you save where you wouldn’t think to normally.

2. Chip

Price: Free

Price: Free

Where Monzo requires a little bit of effort on your part, Chip doesn’t, because all you have to do is link this app to your existing bank account and watch the savings roll in. This handy little bot monitors your spending and works out where you can save money, continually calculating how much you should save each week.

Where other apps offer this data and you can then act upon it, Chip does all the hard work for you, automatically placing the difference into a savings account, meaning you can set a goal and achieve it with minimal effort. This makes Chip the perfect app to use if you want to save for a holiday or to get out of your overdraft.

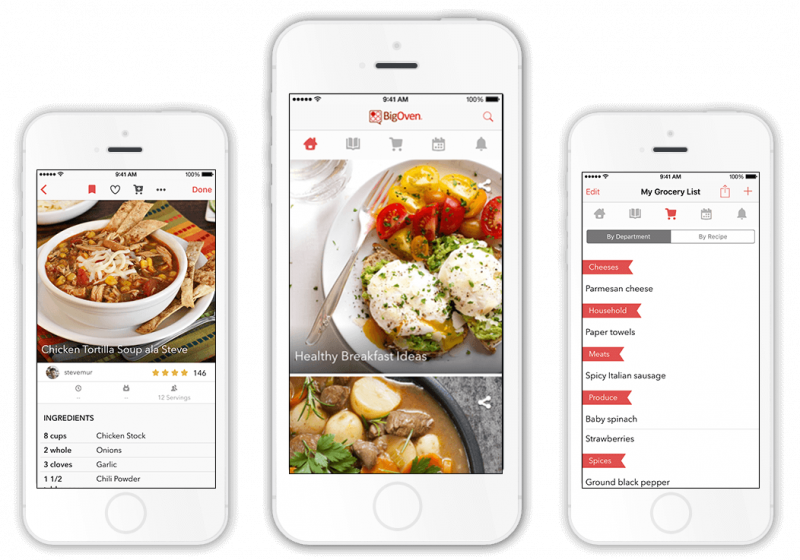

3. Big Oven

Price: Free

Unless you’re a chef, you probably don’t have an in-depth understanding of the food pairings that really work. You know that spaghetti goes with bolognese and bangers go with mash, but what do you do with all those leftover ingredients?

UK households throw away an average of £13 billion worth of food waste each year. This is a big indication that serious cash is being wasted on food items alone, and this is probably a result of people not knowing how to use leftover food. Big Oven is the remedy for that, because it has a function that allows you to enter your leftover ingredients and suggests recipes that use these items.

4. Idealo

Price: Free

Most products aren’t sold exclusively by any one retailer, and this means that the same item is available in several shops at any one given time. The pricing is usually at the shop’s discretion, so shopping around can save you money on the same items.![]()

Now, shopping around can be a bit of a task, and you won’t always be able to cover every single retailer that sells that item – online or offline. Fortunately, Idealo helps you compare prices there and then, meaning you can purchase the item if you’ve got the cheapest price or go elsewhere if you haven’t. It works by scanning the product’s barcode or through a manual search in the app, which then finds and compares all the known prices of that item.

5. Checkout Smart

Claiming cashback on purchases is a money-saving technique that people have used for years. Certain shops and supermarkets will offer a little bit of money back when you buy certain items, and you can claim it back, essentially making your purchase cheaper.

Claiming cashback on purchases is a money-saving technique that people have used for years. Certain shops and supermarkets will offer a little bit of money back when you buy certain items, and you can claim it back, essentially making your purchase cheaper.

It can be a rewarding exercise if you put the work in, but that is the issue: knowing which products can earn you cashback and when to use them can take a lot of effort. Checkout Smart does it all for you, though. All you have to do is buy items that are on the daily-updated cashback list, photograph your receipt, and your account will be credited.